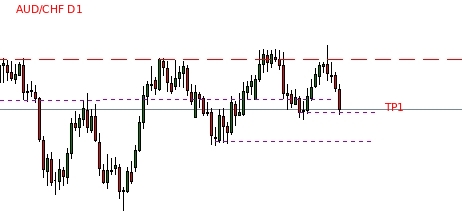

A pingulfing bar printed on the AUD/CHF D1 chart at the top of what looks like a triangle formation. The long-term trend is down and now price is stuck in a range. It looks like price is winding up, so it’s a bit of a risky trade.

The pingulfing bar is large and the level where it formed is very solid. The FTA is close as compared to the risk taken. I won’t take any profit at the FTA, but will move both positions to BE when price reaches that level.

Chart:

Update 1:

The BE point and then the TP1 were both taken out today. Position 2 is now at BE and on position 1 I took a profit of +0.63%.

Update 2:

The second position got stopped out around BE. Price retraced up a little before heading back down. Very unlucky here, because I got stopped out by the pip, meaning that the absolute high of the retracement was where I got stopped out.

Total result of this trade was: +0.63% + 0.04% = +0.67%

Chart: